West Coast Launch of Latinas in VC

Innovation made fun. Great start to the week in San Francisco with the West Coast launch of Latinas in VC. We gathered for two days to meet with collaborating investors, founders, ecosystem builders, and strategics to discuss what we offer, how you can work with us, and our vision ahead.

Our West Coast book launch was featured at SVB’s annual women innovators & capital allocators conference, Trailblazers & Trendsetters: Investing in Women, Innovation, and Wealth. This included a pitch opportunity for women founders with $30,000 of cash grants to keep building their businesses.

Well done conference led by Karen Toste, Tosh E. , and their team at SVB which includes Meagan Williams, Sharon Marichalar, and Jeremy Rich.

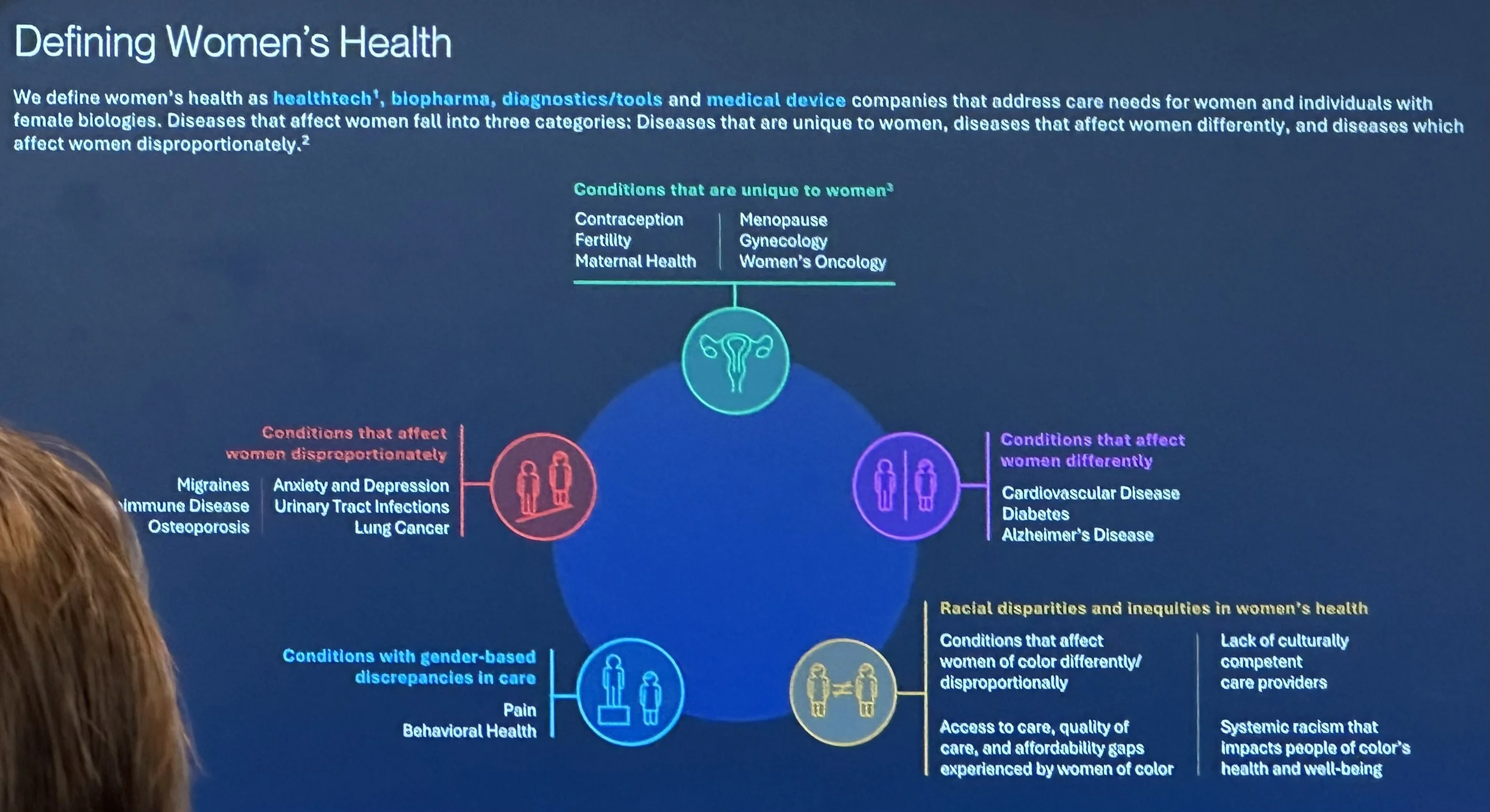

Panel one focused on innovations for women’s health (and general population health improvements). Raysa Bousleiman (covering VCs in Life Science and Healthcare at SVB) presented her research and moderated a substantial discussion featuring the CEOs of two post Series B women founded health companies, Gloria Lau (Co-Founder of Hello Alpha, virtual personalized healthcare) and Anu Sharma (Founder of Millie, specialized maternity care clinics for better outcomes). Millie investors Jessica Karr (General Partner & Founder of Coyote Ventures) and Stasia Obremskey (Managing Partner of Foreground Capital) offered specifics on their investment parameters and strategic support to portfolio companies. The founders articulated how they leverage their data and customer insights in their continuous learning process of refining their business models to scale while navigating the funding process in uncertain times.

SVB's Innovations in Women's Health Report Preview.

Laura Lucas, 2x Startup Founder, GP of L'ATTITUDE VENTURES, and Founder of Libra Leaders presented the first women investors guide, Latinas in VC. Laura then moderated a panel of featured investors, Cristina Apple Georgoulakis, Partner at Seven Seven Six 7️⃣7️⃣6️⃣ , Tanvi Lal, Investor at Intuit Ventures, Kellie Menendez, Operator, Investor, Advisor, and Cecilia Sanchez , Investment Associate at L'ATTITUDE VENTURES . Topics included the paths followed from founder or operator to investor, advisor to investor, and ecosystem builder to investor. The panelists shared their experiences on how they work with founders, their co-investors, and the political posturing often involved to be heard given the range of human dynamics in investment decision making.

Our purpose as capital allocators, as Latinas in VC, is clear. We are dedicated to creating a more inclusive innovation ecosystem through personal efforts as part of our fiduciary duty to our own investors to fund the most promising startups for the best returns.

Excellent presentation by Nerre Shuriah, J.D., LL.M, CMAA, CBEC® of First Citizens Bank on personal finance & wealth building for entrepreneurs covering strategic, cash flow, and tax considerations for founders. Building businesses that last requires the consideration of tomorrow’s desired exit options, regardless of what path you ultimately choose.

A striking influencer of investing in women founders and funders is the historical record of exits by women on both sides of the funding relationship. We are working hard to address the mismatch of talent and opportunity to support a thriving innovation ecosystem making a positive impact on people while delivering outsized returns to investors. These are not mutually exclusive. They are mutually promotive.

Let’s do this thing!

L to R: Karen Sheffield, Joy Fairbanks, Laura Moreno Lucas.

L to R: Joy Fairbanks, Cecilia Sanchez, Laura Lucas, Karen Sheffield, Alejandra Cain, Jacqueline Ruiz.